Investment Lessons from June

Early summer guidance brings signs of lower rates and less government spending, but also more tariffs, war and geopolitical risk

Welcome to July! With a U.S. holiday week ahead, there should be a few moments to digest what last month’s developments signal to anyone managing investments or shaping corporate strategy in the second half of 2024.

Cheaper Money Soon: Conveniently, Friday’s crucial Core Consumer Personal Expenditures index had the slowest monthly increase since 2020, confirming a month of data that show wage and price growth cooling against a backdrop of healthy consumer demand. The European Central Bank kicked off the month with its own rate cut and the Bank of England signaled it’s likely to start in August. This leaves the Federal Open Markets Committee more likely to join the trend in the fourth quarter. Whether it’s before the presidential election or after, whether it’s one cut or two doesn’t matter much. Markets will soon start pricing in a series of cuts (four? six?) next year. That would still be on the tight side for Christmas 2025, with Fed Funds still close to 4%, but it should offer a nice tailwind for equities, foreign currencies and, maybe, a few well-placed emerging markets.

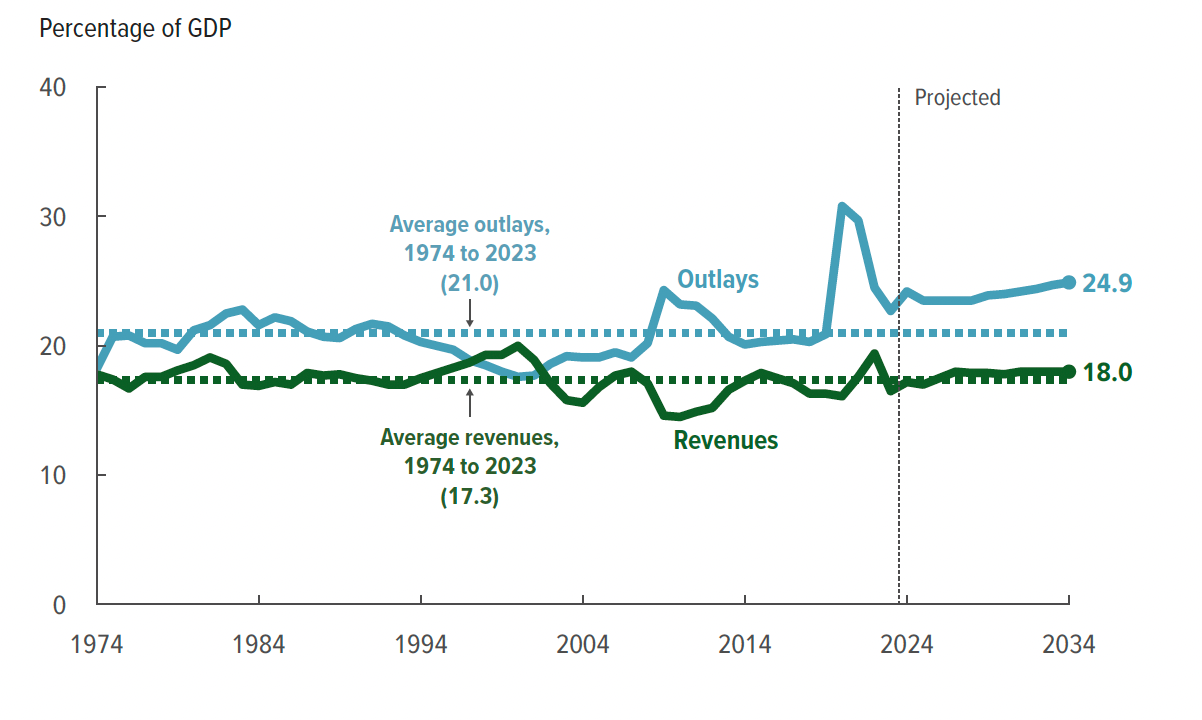

Tighter Budgets Ahead: It’s too soon to judge if Joe Biden’s shaky debate performance on Thursday will dramatically change the U.S. presidential race, but polls consistently show a country straddling deep rifts on issues of immigration, abortion and America’s role abroad. Still, both sides will have to find a compromise on the budget next year as the 2017 tax cuts expire. Doing nothing will deliver a recessionary jolt to corporations and households while making them permanent without spending cuts would double the national debt in 30 years. With neither party likely to control both Congress and the White House, watch for a combination of deficit-reducing cuts in both revenues and spending. We also learned last week that Europe will be in deficit reduction mode, too, as France (regardless of election results), Italy and four other countries may face fines by Brussels unless they bring their budgets in line.

Tariffs Heading Higher: The Biden Administration’s targeted tariffs on Chinese imports in May were less of a surprise than the European Union’s June announcement of potential tariffs of up to 38% on electric vehicles from China. These measures will be watered down as Beijing and Brussels announced talks, but the global outlook changes substantially when an economic union founded on free trade starts raising barriers with a key partner. And that’s even before assessing the odds of former President Trump’s promise of 10% tariffs on all (sic!) imports. Whatever the political or industrial benefits of these tariffs and the retaliation they trigger, they will complicate the decisions of central banks as they defend their 2% inflation targets.

Wars Still Escalating: Even three months ago, before Congress liberated a package of Ukraine support, there were grim assessments that Kyiv would have to take a deal on Russian terms and that at least a cease-fire was in sight. But with Russian advances flagging in June and fresh commitments from G-7 leaders, Ukraine is now hoping to mount a successful effort to reclaim its land next summer. Meanwhile, Israel’s government and Hamas brushed aside any talk of a cease-fire in Gaza even as the humanitarian conditions deteriorated. What became depressingly clear is that a peaceful solution could be years away. Regional stability may hold for now since no neighbors want a wider war and global oil supplies look ample, but the risks of something much worse grow with every month the conflict persists. Even with a surprise pause in hostilities in either war, global defense spending will keep rising in most major economies -- and many smaller ones, too.

Asian Powers Shifting: U.S.-China tensions still seemed contained last month, but risks were rising elsewhere. The Chinese have been careful not to send military supplies directly to the Russian army, but Putin’s May visit to Beijing underscored how trade in just about everything else has helped rebuild his defense industrial base despite Western sanctions. Then Putin hit the road again in June. In North Korea, he tightened defense commitments and secured more munitions. In Vietnam, he declared that there is no room for “closed political-military blocs,” tweaking what had been a warming relationship between his hosts and the Biden Administration and complicating a historic Vietnamese rivalry with China. Where the shifting parts relationships come to rest remains anyone’s guess, but global efforts to de-risk supply chains from China and Russia have just become even more complicated.

This month will surely bring its own economic and political surprises, but the real shock would be anything that suggests a global economy headed for fresh inflation, lower trade barriers or any hint for geopolitical reconciliation.