All Geopolitics is Local

The best way to track what comes next in the Trump trade war may be through opinion polls and stock prices.

The flurry of policy proposals, executive orders and social media posts over the last three weeks mean one of three things: a) a brash and iconoclastic leader is back on the job, b) an overextended great power is fighting to maintain its dominance or c) the American people have once again voted for radical change in foreign policy.

The correct answer is d) all of the above. But c) may be the best angle to make sense of it all because the interaction of public and market opinion will do more to shape American foreign policy over the next four years than anything Donald Trump or Xi Jinping want to accomplish.

It’s hard to put seizing control of Greenland, imposing tariffs on neighbors and rebuilding Gaza into a coherent strategic vision. But it makes a little more sense if you think instead of a political leader with brash ideas, an improvisational style, and a keen interest in showing his constituents that he has hit the ground running.

The last-minute suspension of tariff threats against Canada and Mexico last Monday looked highly choreographed as Prime Minister Justin Trudeau and President Claudia Scheinbaum promised border measures that were already in the works. But it also looked like a timely reaction to powerful protests from business executives, union leaders and the stock market.

The market recovery since then looks tentative, at best, as investors assess the confrontation looming ahead between the U.S. and China. For now, Trump and Xi are still circling the ring like old boxers sizing up their opponent. Trump’s 10% levy on Chinese exports looks like a modest opening salvo compared to his campaign rhetoric, while Xi’s response included a mix of tariffs, export controls and an anti-trust investigation of Google.

In the absence of a grand plan, Trump still seems to be deciding just what he wants from Xi. His persistent focus has been the bilateral trade deficit, which surged to $295 billion last year. But he and his advisors have also spoken of decoupling or at least reducing reliance on critical supplies like steel, pharmaceuticals or semiconductors. Meanwhile, Treasury Secretary Scott Bessent seems to harbor old-fashioned ideas about tariffs helping to end unfair trade practices.

The problem with China, as we all know, is that it’s both America’s top geopolitical rival and third largest trading partner. You can send the Seventh Fleet to the South China Sea or denounce the dismantling of Hong Kong’s democracy with confidence that your voters will like your display of backbone.

But tariffs make imports more expensive, which hurts corporate margins, squeezes consumer pocketbooks and threatens jobs. Sanctions and export controls create a lengthening list of customers who are off limits with similar costs.

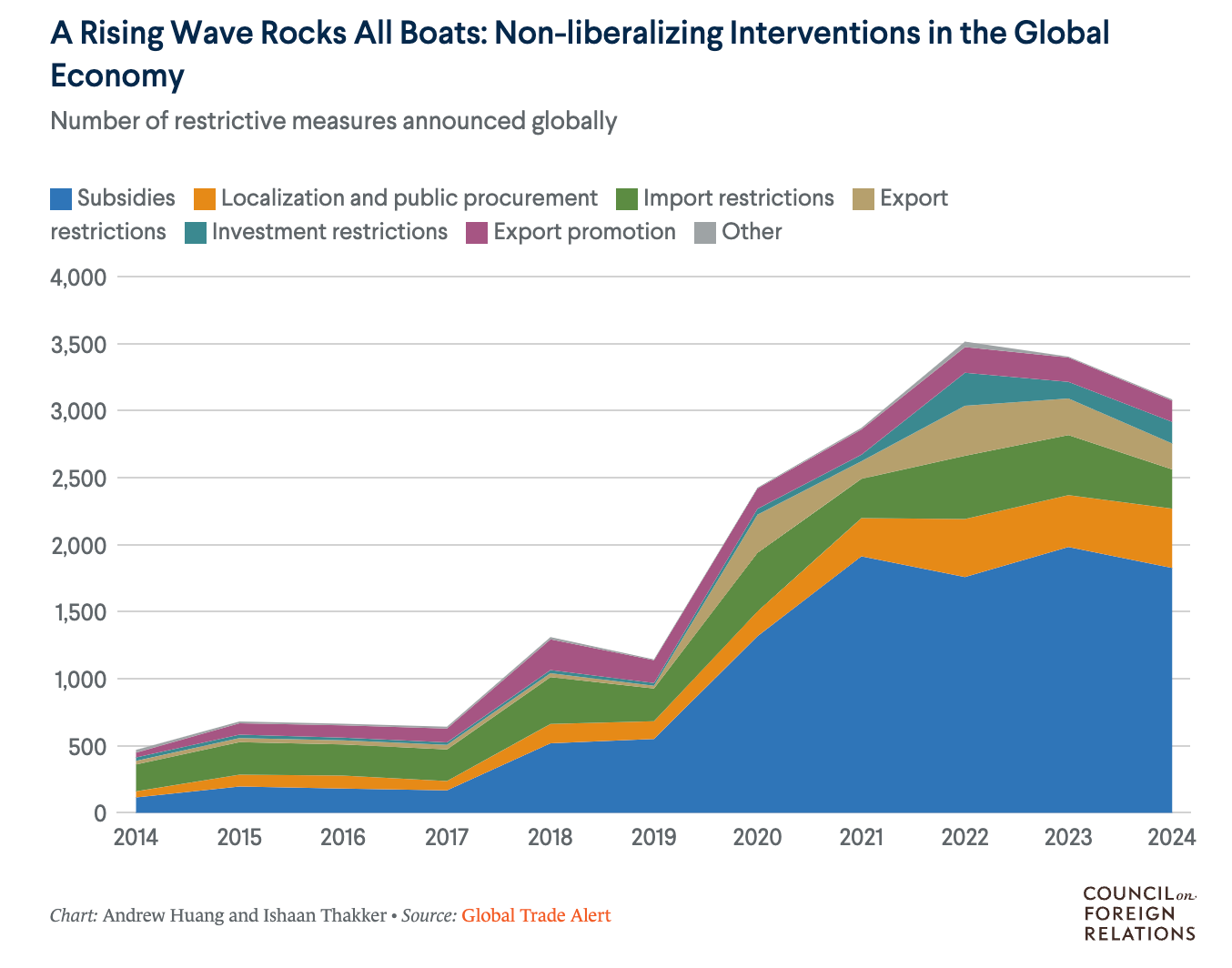

International commerce has never been fully free, but there’s a clear trend to more government intervention since the first Trump administration. Indeed, Joe Biden famously expanded on Trump’s first round of China tariffs and leaders around the world have increasingly resorted to these tools, whether from an outright national security concern or plain old protectionism.

But with all the attention to the looming showdown with Beijing, it’s even more important to watch shifting opinion at home. Witness the fraught balance Trump has struck over TikTok, which was a clear security threat until it turned into a powerful political constituency. The rare Washington consensus on limiting China’s access to the latest microchips is now under pressure from industry that is chafing at restrictions sales to a juicy market.

All this means the evolution of the U.S.-China trade relationship will be shaped as much by what voters think as by any threats or concessions tabled by Beijing. Trump clearly arrives in office believing in his mandate to make bold moves and issue grave threats. American opinion of China has never been lower. Yet even before the dust-up with Canada and Mexico, there was mounting trepidation that the new administration might go too far.

Xi has his own domestic considerations as his economy slows and trade tensions rise again. His abrupt lifting of COVID lockdowns in late 2022 shows that even an authoritarian leader has to keep his finger on domestic sentiment. Tariff escalation may well get caught up in genuine Chinese outrage over steps toward Taiwanese independence or a naval collision off the Second Thomas Shoal.

But American presidents, including this one, are even more sensitive to domestic sentiment and market moves. For executives managing a global business or investors formulating a portfolio strategy, the best way to track the evolving showdown will be to understand that even tectonic geopolitical shifts depend in one way or another on what the folks back home have to say.

Who is advising our dear leader on economic or trade policy, apart from the stock market? If you find a rational calculus somewhere, let me know because I'm looking for it.