As The World Turns

Amid all the tariff threats and Executive Orders, most of the rest of the world will see a major expansion in global trade regardless of what Washington does

A long-ago radio and TV serial offers a reminder not to get lost in the soap opera playing out in Washington these days. The tariff and export control decisions made by the Trump Administration will have important consequences for the United States economy and a few global industries as they take shape in the months ahead. But the basic trends in global trade already look locked in for the next decade regardless of what the new president decides.

Watch for a major reorientation in China, significant gains for the Global South and some tough sledding for Europe.

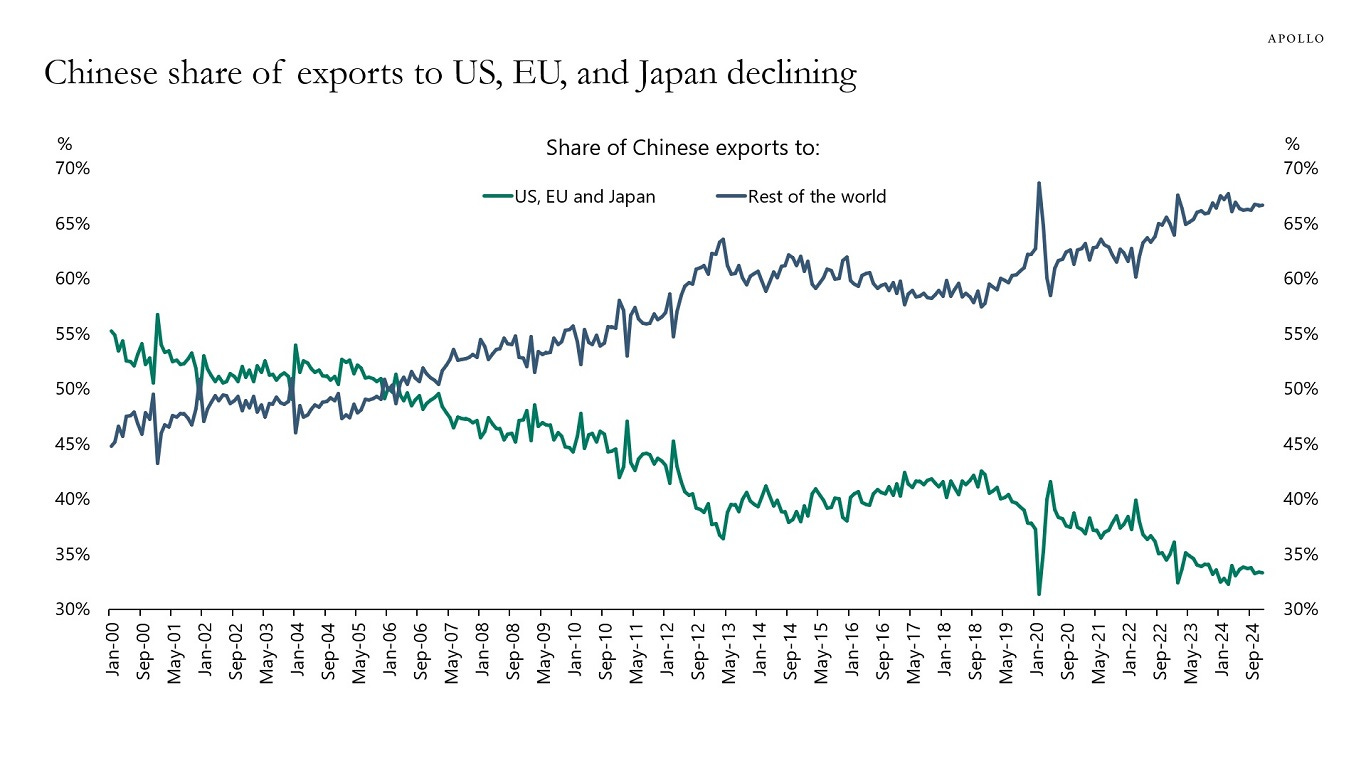

First, remind yourself how China’s trade dependence on the United States and its allies has been declining for 25 years. Of course, the U.S. market is important to Beijing, but it has been falling as a share of Chinese exports even as overall exports have grown less important to China’s GDP growth.

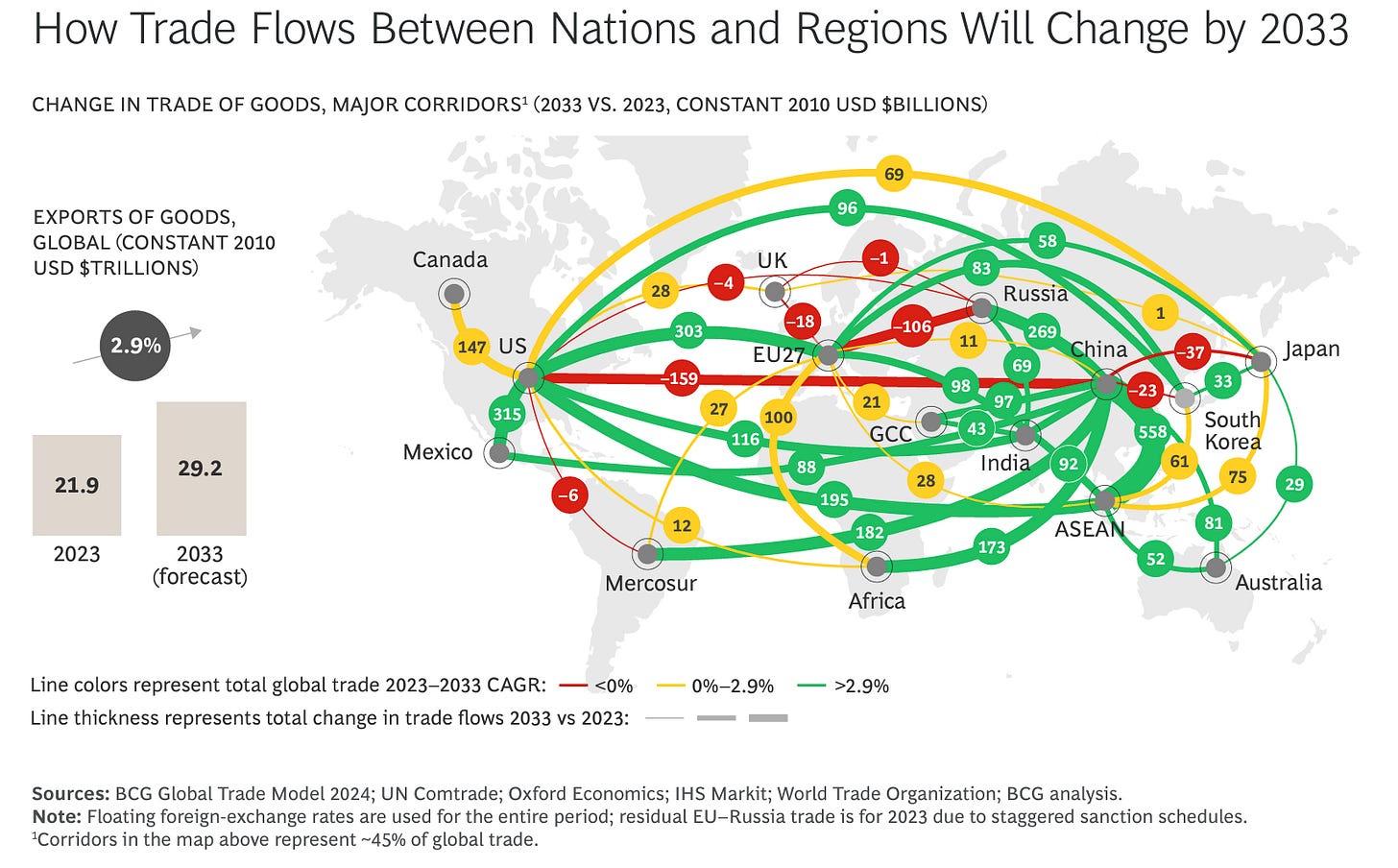

Then take a few minutes to absorb this chart from a fresh Boston Consulting Group study that projects changes in global trade flows over the next decade. It’s a little busy but just look at the colors and the thickness of the lines.

Notice the red lines that show precipitous declines in trade between the U.S. and China and between Europe and Russia.

See the green lines that converge in China and reflect forecast trade growth in constant dollar terms with developing countries in Asia, Africa and Latin America. China’s annual trade growth will slow to 2.7% over the next decade from 4% over the last decade, but there will be a generous cushion elsewhere for any loss in U.S. markets.

Now pay close attention to the trade growth in ASEAN and India, which will likely power a rapid expansion of commercial ties across the Global South.

Europe will see its China trade stagnate while relying more on trade with the U.S., Turkey and Africa.

The U.S. will see reduced trade with Asia while increasing commerce with its North American partners and Europe. The authors speculate that the much larger tariff increases Trump has promised may slow that growth while accelerating these other global trends.

No forecast is completely reliable over any 10-year period and today’s geopolitical uncertainties make for an even larger margin of error. But some trends look unalterable for the next decade. And this exercise should remind us in any case that there’s a big world out there that continues turning regardless of what happens in Washington.

The consequences may be unintended, but they are foreseeable!

Interesting even-keeled comment amid the flooding zone. Perhaps because I have been thinking along these lines, I would note that the share of global trade represented by the US continues to fall, the reliance of the global south (and others) on the China market continues to rise, and as a result trade (i.e., tariffs) used as a tool of political leverage by the US is likely to have unintended if not outright counterproductive consequences.