Terrible Ideas, Part 1

Threatening tariffs to protect the dollar’s status is like threatening to punish a child - who already hates you

If there are any upsides this week to the pardoning of Hunter Biden, South Korea’s brief flirtation with martial law or the French budget crisis, it’s that they have buried President-elect Donald Trump’s weird rant policy proposal to slap tariffs on countries backing a BRICS currency as an alternative to the dollar.

I try to limit political diatribes in this space. In part, there are so many others who fulminate more effectively. In part, I think the 77 million citizens who knowingly voted for Trump should have their views taken seriously, at least until the man takes office.

But when I saw the headlines from respectable analysts linking the dollar’s bounce to Trump’s tweet (or “Truth” as it is branded on his own social media site), it suddenly seemed important to set things straight even from my own small soapbox.

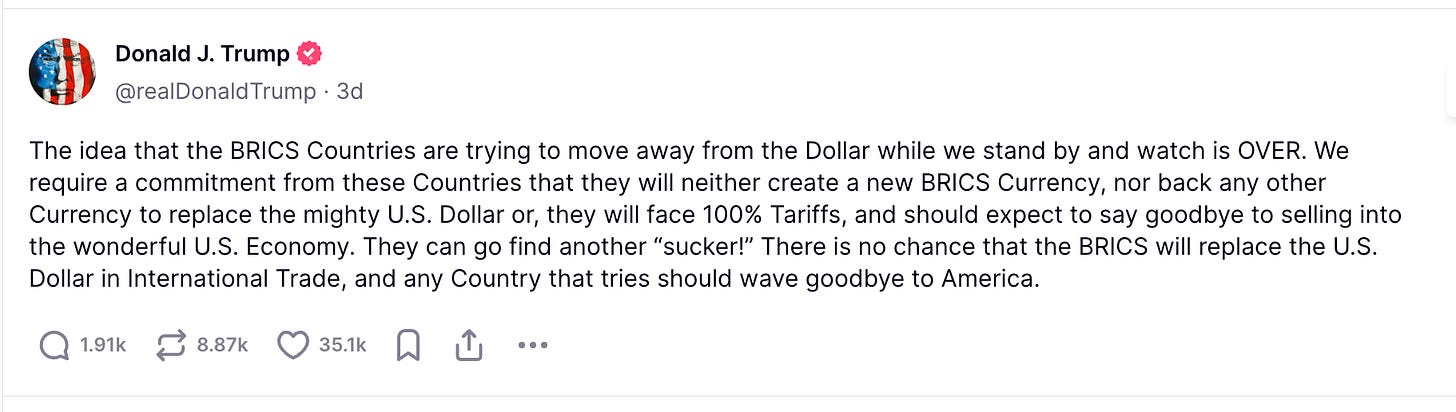

Recall these were his words (and punctuation):

First, there’s zero chance of a BRICS currency. Okay, there’s a very tiny chance, but it gets smaller every time a new country joins the ramshackle team anchored by Brazil, Russia, India, China and South Africa. As our European friends would remind us, currency unions require at least some alignment of economic drivers, a bare minimum of fiscal policy coordination and a passing attempt at financial market integration. These countries, now also including Egypt, Ethiopia, Saudi Arabia, the United Arab Emirates and Iran, share very little economically, let alone politically. Some export oil, some import oil. Some are quite industrialized, and others are - not. To the extent that there might be cyclical alignment, it would be around China, which accounts for 70% of the group’s output.

Second, the dollar dominates global commerce because individuals, firms and countries choose it for transactions and investments, not because of any inter-governmental agreement or plot cooked up by Vladimir Putin and Xi Jinping. The dollar is a proxy for the world’s largest and most dynamic economy. It also provides access to the deepest and most sophisticated financial markets. And it’s backed by independent courts, regulators and central bankers that mostly advance good policy without regard to the next election. There are some things that Trump has done and promised that may lead folks to question how long these institutions will remain intact, but for the foreseeable future, the dollar will account for two-thirds of reserves, half of export invoicing and almost 90% of foreign exchange transactions.

Third, what these countries really want is a means of transaction that avoids U.S. financial sanctions, which Washington has deployed in rare bipartisan alignment and abandon. This is why the recent BRICS summit in Kazan, Russia, discussed digital ledger technology that would settle transactions among central banks without passing through dollars. But if the point is to avoid the U.S. financial system altogether, the threat of tariffs will probably only redouble their efforts to explore alternatives. If you don’t believe me, just try warning an angry and rebellious 10-year-old to stick to your family’s sturdy see-saw when the neighbors just installed a trampoline.

For more of my extensive (and fascinating) thoughts on the dollar’s role as a global reserve currency, please take a look here, here and here.

Meanwhile, I’d welcome any theories about why Trump has picked this battle. Is he rallying his base or just winding everyone up on a slow news day? Does he want to encourage the world to hold dollars, which will make the exchange rate stronger and the trade deficit worse, or is the managed chaos designed to drive the currency lower? Maybe he’s just tweaking his incoming economic team. Who wouldn’t like to see sophisticated financiers and economists like Scott Bessent, Howard Lutnick and Kevin Hassett defend this one with a straight face?

I can’t answer any of these questions. But I do know that his proposal is a terrible idea, and I think it’s important to say so.