This Week's Chart, Next Week's Markets

To ponder and to watch

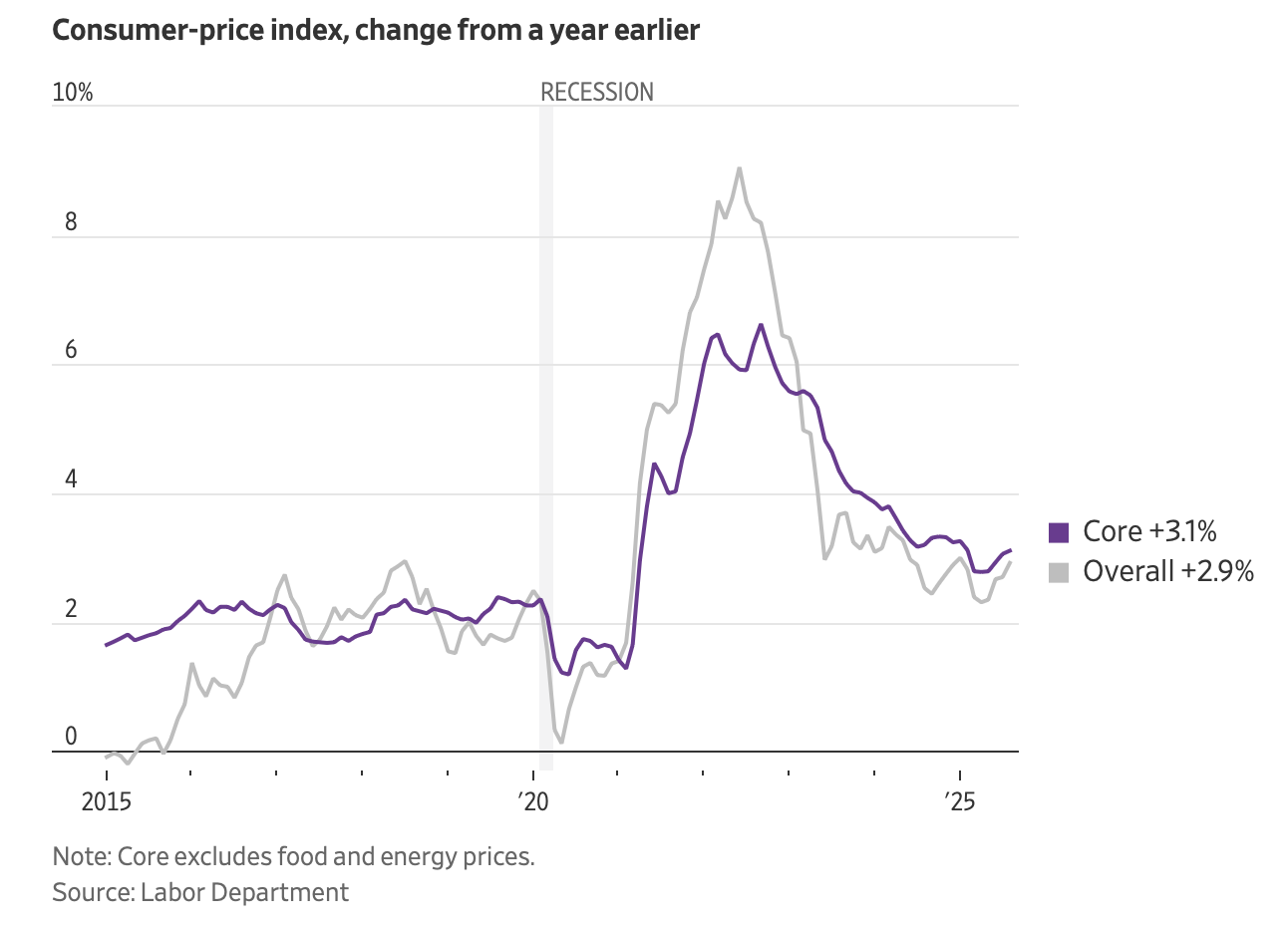

Sure, with the current jobs data, it seems sensible to cut rates a little. But with core well above your target and rising, do you really want to cut a lot?

Geopolitical Events That Could Move Markets

FOMC Meeting (Tuesday, Wednesday): At last! A modest 25 basis point cut looks locked in, but there will surely be back-chatter about having Stephen Miran and Lisa Cook at the same table. Who said what? Who smiled at whom? Did the Fed building feel like edged eastward slightly toward the Oval Office?

China Retail Sales and Industrial Production (Monday): The forecasts are good with retail sales in line with July’s 3.7% increase and IP weakening ever so slightly to 5.6% higher than last year. But there will be lots of close analysis for signs of weaker domestic demand and hiccups in exports from U.S. tariffs.

Skies over Ukraine (all week): Following UN Security Council and NATO consultations on Friday concerning Russian drones entering Polish airspace, will attacks on Ukrainian civilian targets continue as before or will Moscow signal a desire to cool tensions? Will the Trump administration feel it needs to respond? Even if it doesn’t, markets should brace for the conflict to heat up even further.