This Week's Chart, Next Week's Markets

Global rates, Russia talks, China trade, U.S. CPI, FOMC and U.K. GDP

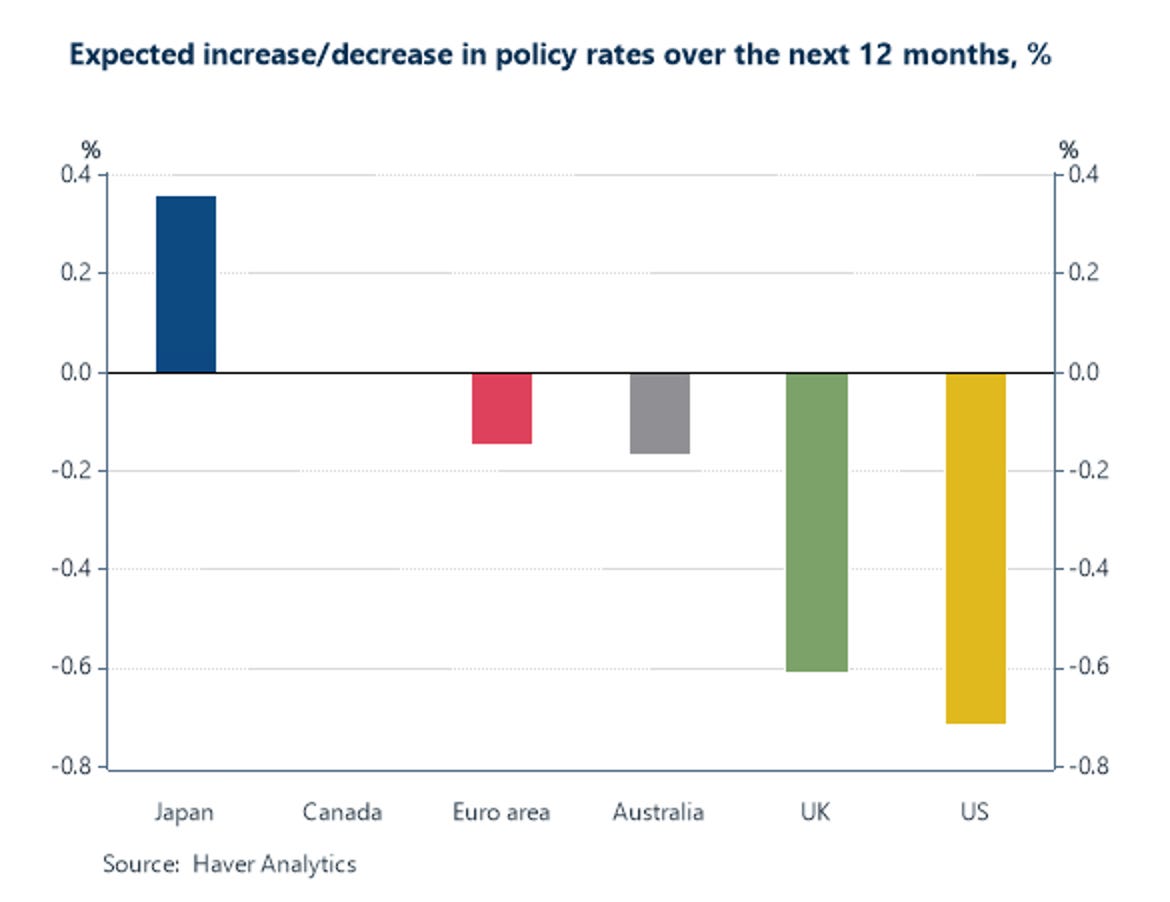

Amid next week’s hyperventilation around the Fed decision to cut rates, consider the broader picture. Regardless of who becomes the next Fed chair, U.S. rates seem likely to head at least a little lower from here. But as the Bank of Japan turns in earnest to fighting inflation and begins tightening, the shape of global flows will change substantially. A major source of global capital may choose to stay home in Japan rather than fund carry trades, bitcoin treasury companies or the U.S. deficit.

Meanwhile, watch next week for:

Monday: Continuing talks about a peace agreement between Russia and Ukraine will keep investors curious, if not hopeful. A sudden breakthrough seems unlikely given the number of constituencies that need to get comfortable with any final settlement, but watch for oil price volatility.

Wednesday (really early): China is expected to release resilient export numbers. Weaker import data will likely reflect poor domestic demand.

Wednesday (early): U.S. Consumer Price Inflation for November is due out in the morning, with hopes that the core number will be cooling.

Wednesday (later): The Federal Open Market Committee’s likely decision to cut rates will look awkward if inflation comes in higher than forecasts.

Friday: U.K. monthly GDP estimate for October will likely reflect continued stagnation for an economy facing tighter fiscal policy that will weigh on consumer spending.