This Week's Chart, Next Week's Markets

Greenland, earnings, Fed, Japanese jobs and European growth

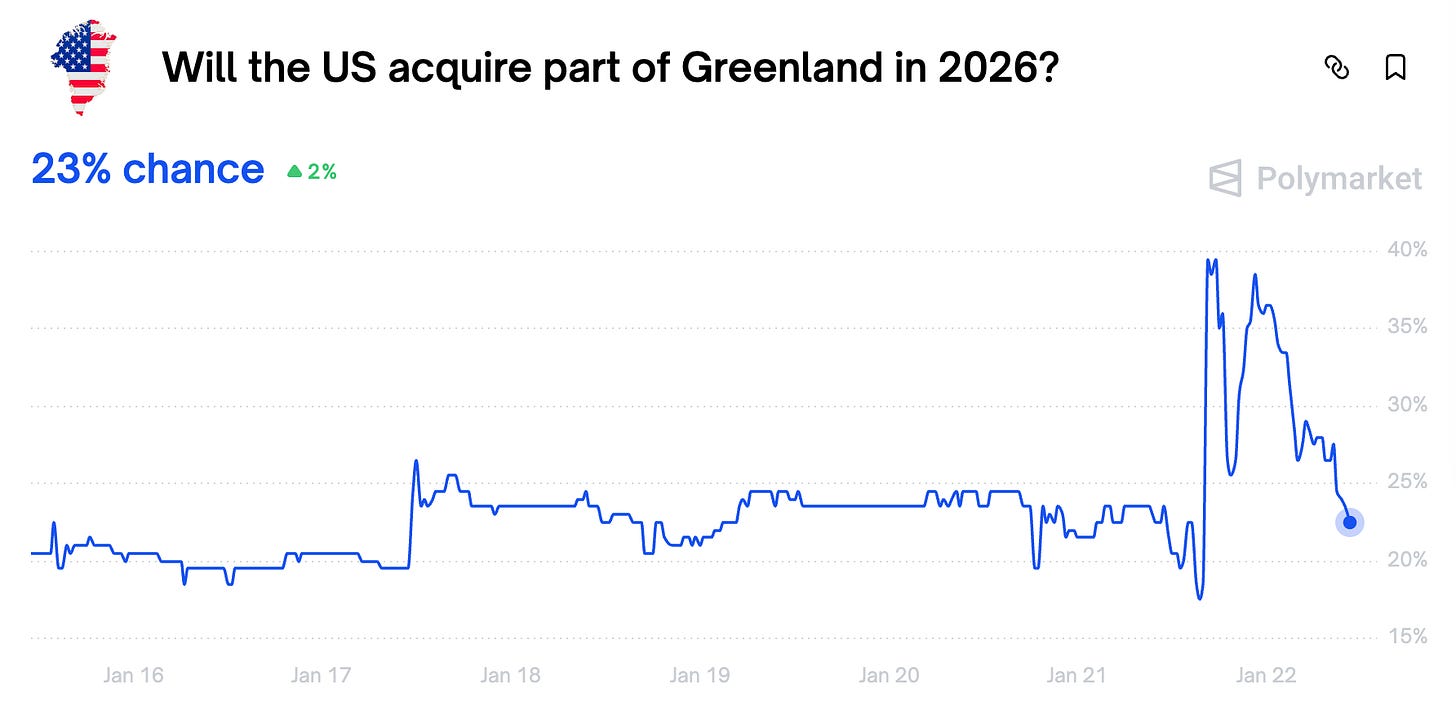

Well, that was quick. You can’t help feeling that you were swept away once again by the president’s excessive rhetoric, when he was really just knocking his negotiating partner off balance to secure better terms. Even the betting markets were briefly taken in, but by the time Trump had returned to Washington, the visions of U.S. troops landing in Nuuk had given way to protracted discussion of a long-term lease. Nevertheless, the damage to NATO’s credibility has yet to be fully measured.

Next week, brace for potential crises from Minneapolis to Caracas and Tehran to Kyiv. And circle these dates on your calendar:

Monday: If Trump’s transatlantic tariff threats are no longer on the table, markets can get back to analyzing the IMF’s upgrade of global growth and what is expected to be a healthy earnings season. Today, watch for United Airlines and Steel Dynamics.

Wednesday: Fed probably holds steady on rates, but the press conference will focus on anything Jerome Powell says about the Justice Department investigation. So far, he has avoided open confrontation with the White House, but those days seem over.

Thursday: Japanese unemployment and industrial production may fuel a further rise in yields if they come in above expectations. For financial markets, this is a far bigger story than any of the geopolitical entertainment.

Friday: European GDP and unemployment readings will likely confirm that Europe is holding steady, but remains unlikely to outperform the U.S. this year.