This Week's Chart, Next Week's Markets

Election Day, BoE, Chinese manufacturing, [no data]

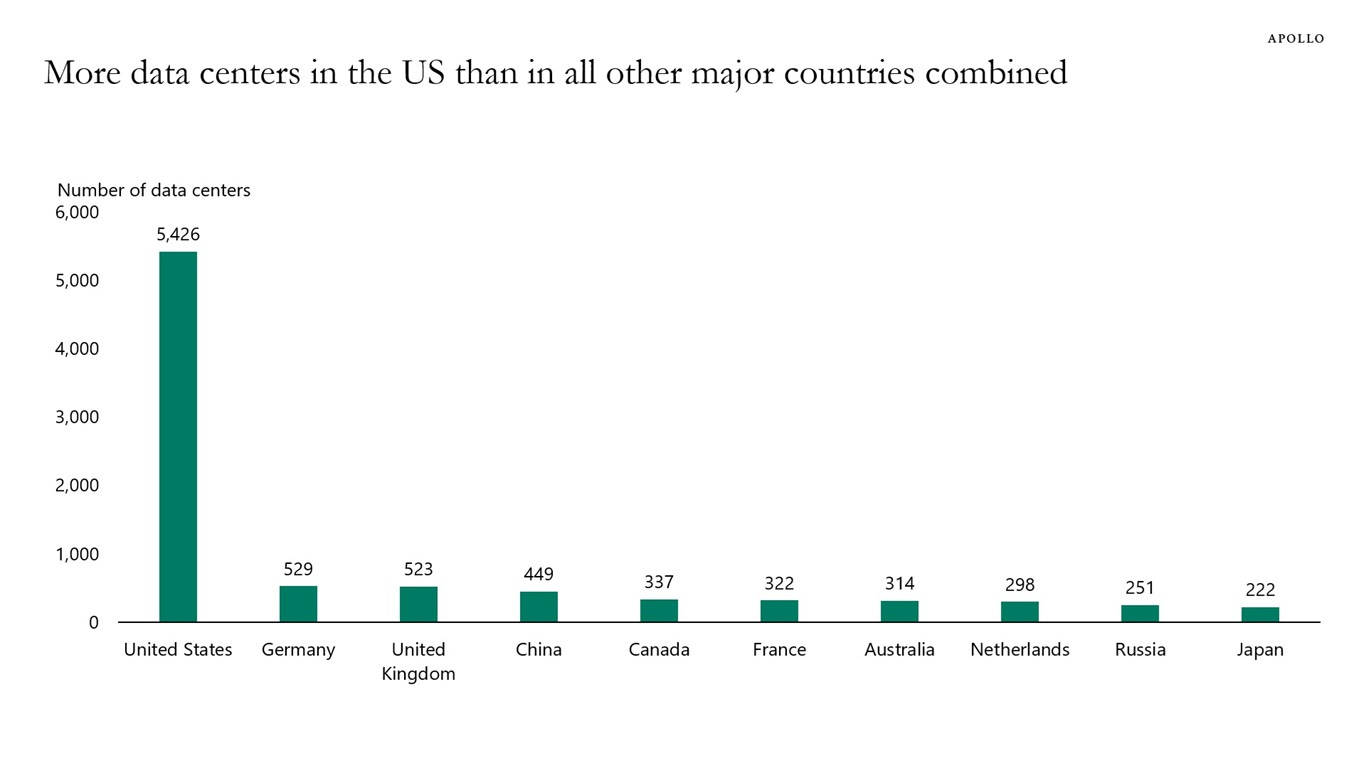

This chart should either make you think that America will unquestionably dominate the next age of artificial intelligence or that we are in the midst of a bubble that will inevitably end in a spectacular bust. I lean toward the latter, but the timing depends on how many AI commercials there are during next year’s Super Bowl.

Elsewhere next week, look for:

Tuesday: U.S. elections will offer fresh evidence on the mood of U.S. voters nine months into the second Trump presidency. Watch the margin of victory for Democrats in the gubernatorial races in New Jersey and Virginia. (A Republican victory in either state would be a massive boost for the president.).

Thursday: Bank of England policy seems more likely than not to cut rates 25 bps to 3.75% as the economy cools, but markets will be sensitive to anything that drives inflation towards 4% in the coming weeks.

Friday: Chinese manufacturing data is expected to show little or no growth, reinforcing deflationary concerns.

Friday: Investors (and rate-setters) will have gone for 38 days without official U.S. government data.