This Week's Chart, Next Week's Markets

Surprises, Continuing Resolutions, UK inflation, Chinese rates, Global Manufacturing

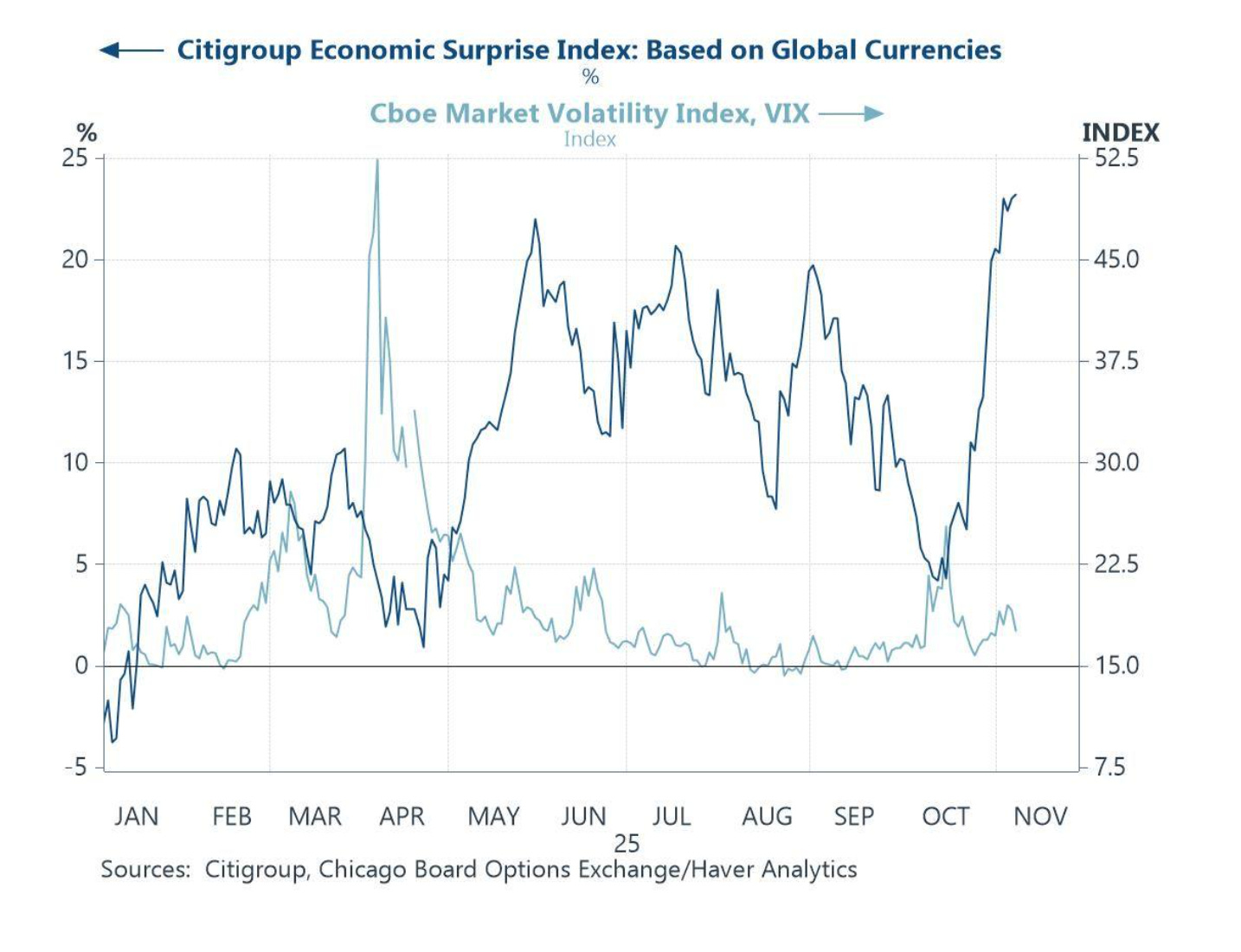

If you are among the many who are puzzled by the roaring stock market, don’t be fooled into thinking that things are great. Actually, stock prices keep rising because things are less bad than expected, as measured by our friends at Citi. But a low VIX reading suggests investors aren’t braced for a negative surprise — whenever the fresh government data reappears.

Speaking of data, you will find our most recent rant here. We’ll be getting the September jobs readings soon, but we may never know what happened in October….

Elsewhere:

Monday: The House and Senate return to work with 78 days to go until funding runs out again on January 31.

Wednesday: UK Consumer Price Index seems likely to confirm persistent inflationary pressures from the 3.8% reading for September. Watch for a stronger pound.

Thursday: The People’s Bank of China is expected to hold rates steady at 3%, but there may be signals on the direction of policy that will roil Asian markets.

Friday: S&P Global releases preliminary PMI manufacturing readings for the U.S., the U.K. and euro area that will offer small windows on just how much tariffs are shifting supply and demand.

I am one of those who are confused by the roaring stock market. I heard a senior treasury official say some years ago that capital was a coward. Well, apparently not. What does the stock market know that people like me (freaked by what they see) do not? Or are we in another fateful phase of irrational exuberance, a bipolar rush of extravagant enthusiasm before the clouds gather and the mood and the market plunges and crashes? I understand it wouldn't be for the first time.