This Week's Chart, Next Week's Markets

Venezuelan debt, US inflation and retail sales, Chinese production and German prices

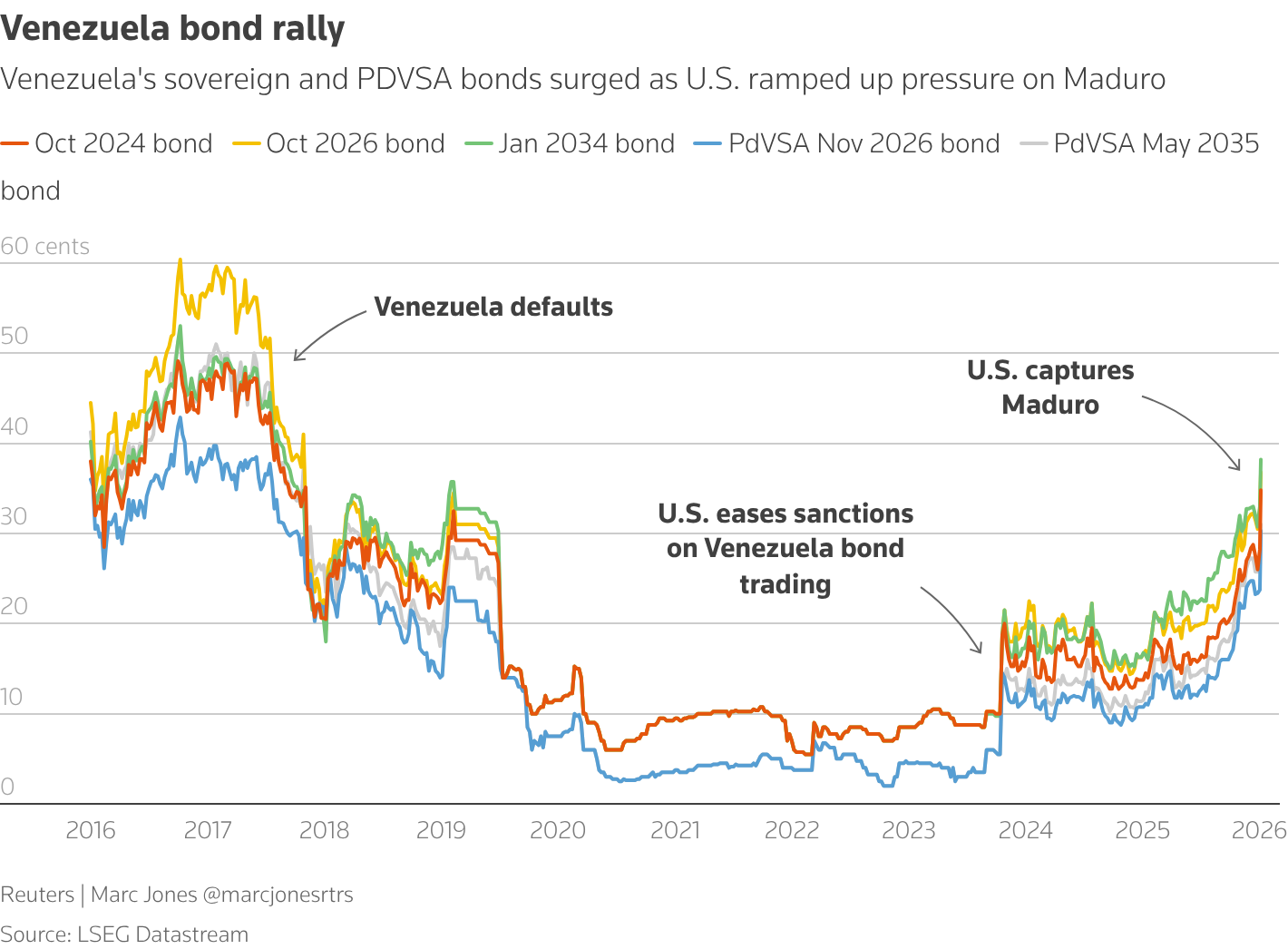

As investors make sense of ongoing peace talks in Ukraine, the end of defense stock dividends, and prospects for Greenland’s sovereignty, they will also need to find time next week to consider how much of a distraction Venezuela may become for Washington. For all the talk of oil, drugs and immigration, there is surprisingly little mention of the country’s defaulted or distressed debt that may reach $150 billion or twice the size of the economy.

Also next week, brace for:

Tuesday: U.S. consumer price inflation is likely the most significant market mover next week, as it will set the tone for expectations of the Fed Funds rate this year. Forecasts are for a headline number that still looks high at 2.8-2.9%.

Wednesday: U.S. retail sales should come in strong, given the latest GDP readings, and could fuel inflation fears if they come in too hot.

Thursday: Chinese Industrial Production and Retail Sales could bolster global commodity prices if they beat already robust expectations.

Friday: German inflation should come in on the cooler side if goods and energy prices are enough to offset sticky services inflation.