This Week's Chart, Next Week's Markets

Inflation, Davos, Chinese growth, European PMIs and Japanese rates

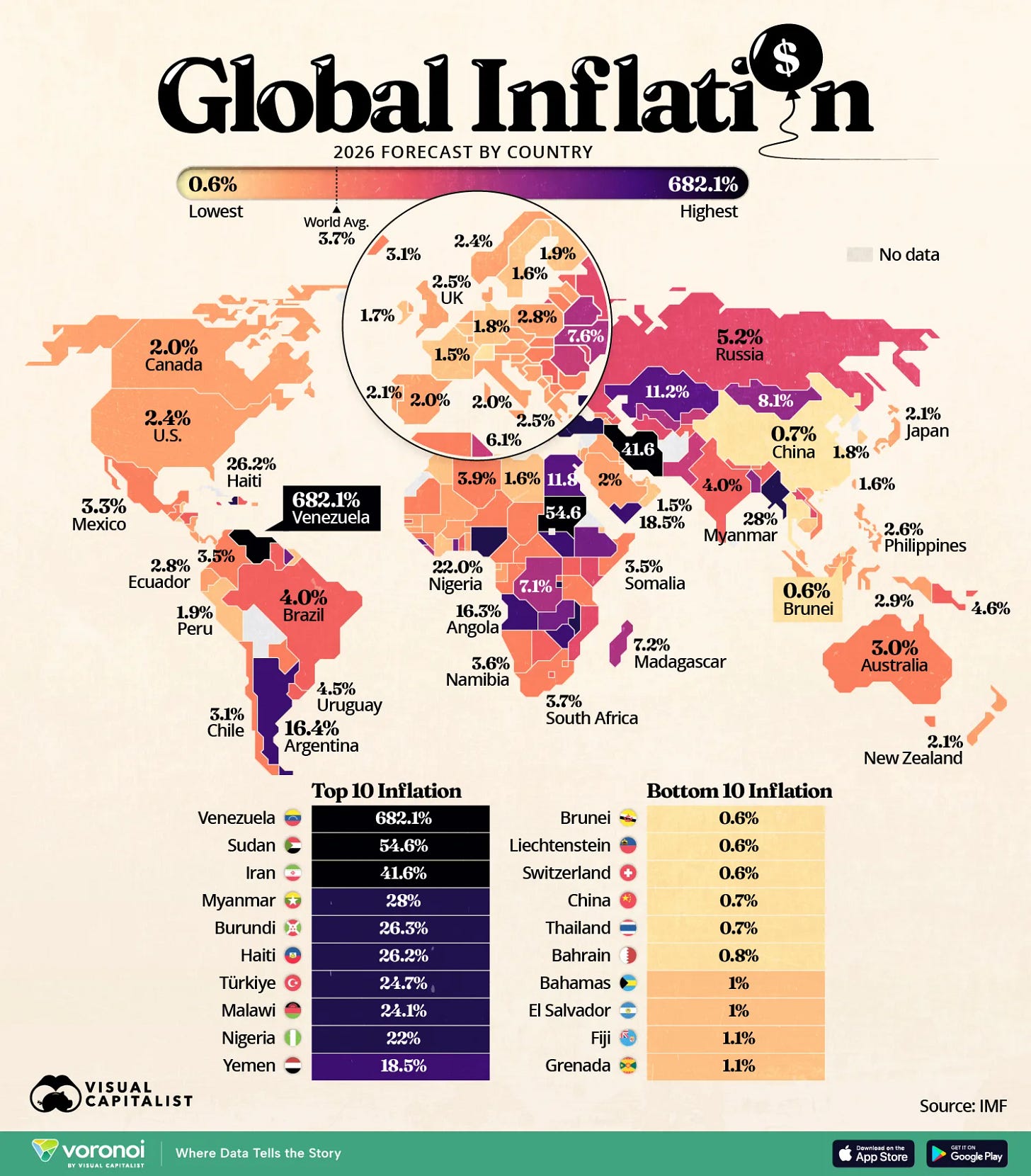

Next week’s most important U.S. economic release is likely the Personal Consumption Expenditures (PCE), the Fed’s preferred inflation gauge, so it’s worth offering a little context to America’s struggle to bring inflation back to its 2% target. Give a thought to monetary policymakers in Venezuela, Sudan and Iran.

Meanwhile, next week, watch for these headlines:

Monday (Europe): Davos opens with talk of AI, inflation, Greenland, tariffs, Venezuela and lots of speculation on whether Jerome Powell will now stay on at the Fed after his term as chair ends in order to deprive President Trump of a majority of his own appointees. But Trump himself will be there, too, and will doubtless make headlines on some or all of these topics.

Monday (China): Readings on industrial production, retail sales, and fixed-asset investment are all due. Most attention will likely go to 4Q2025 GDP, which is expected to be near 4.8% with strong industrial production and weak consumer spending.

Thursday (US): U.S. Core PCE is currently expected to print near its previous reading of 2.8%. Anything that deviates significantly will send markets lower, either due to fears of delayed rate cuts or a looming recession. Expect a healthy report for 3Q2025 GDP, too.

Thursday (Europe): Flash PMIs from Germany, the U.K. and the euro area are currently hovering right around 50, the tipping point between expansion and contraction.

Friday: Bank of Japan seems likely to hold rates at 0.75%, but any further signalling of tighter policy ahead will boost the yen.