This Week's Chart, Next Week's Markets (29ix25)

Debt, Gaza, Shutdown, Euro, Jobs

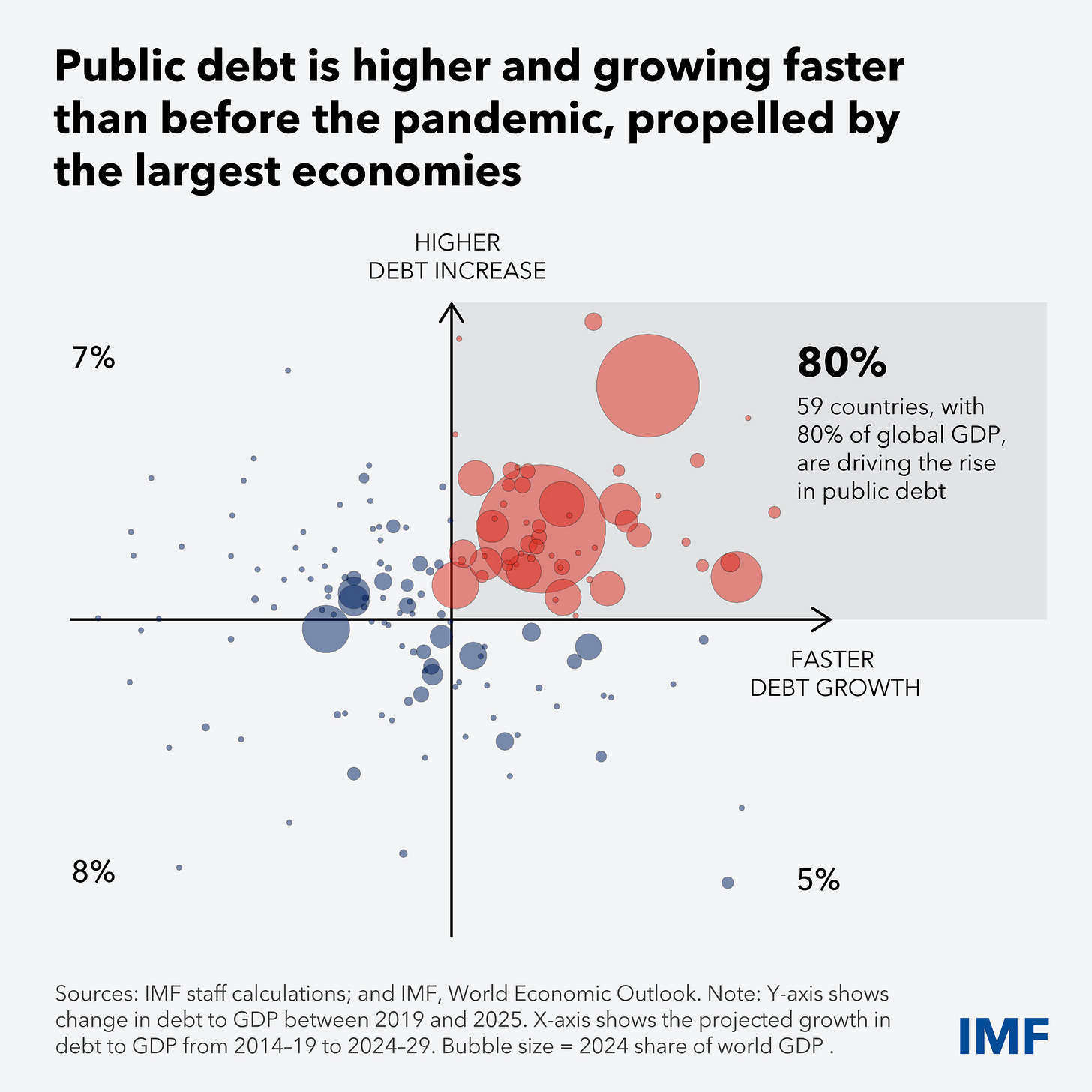

Your latest reminder that the world has a growing debt problem. You probably already know that poor countries are not the problem this time around. Growth is the answer, of course, but a little spending restraint in the world’s richest governments wouldn’t hurt either.

As for markets next week, watch for:

Monday: UNGA closes with a virtual speech from Palestinian President Mahmoud Abbas, but more attention will go to any progress or uptake on the 21-point peace plan President Trump shared with Middle East leaders this week.

Tuesday: The U.S. government shutdown is scheduled to begin at midnight. For all the current talk of an impasse, the Democrats may be forced to cave on their demands so they don’t get blamed for a massive round of layoffs the president has threatened. But there’s plenty of room for surprise and miscalculation. The problem with such sour interparty relations is that it could take some time to negotiate the reopening.

Wednesday: The Eurozone CPI has been consistently hitting the ECB’s 2% target for several months, which likely means further rate cuts and euro weakness.

Friday: U.S. monthly payrolls will get plenty of attention. Good news on jobs means bad news on Fed rate cuts. However, be cautious of any downward revisions to earlier data, which may cloud the current outlook.